The $10 million shareholder gain limitation takes into account all gain recognized from the sale of QSBS in each issuing corporation. The amount of gain a shareholder may exclude from gross income upon the sale of QSBS originally issued after September 27, 2010, is limited to the greater of $10 million or 10 times the shareholder’s adjusted tax basis in the stock. Collectively, sections 1202, 1244, and 1045 are provisions that level the playing field for C corporations which have traditionally been subject to two levels of tax, thereby reducing the federal income tax law's bias against C corporations, if certain stringent requirements can be met. Both section 1244 and section 1045 contain their own complex set of rules that are outside the scope of this alert. Section 1045 allows for the rollover of QSBS (sale of existing QSBS and purchase of QSBS in a different issuing corporation within 60 days).

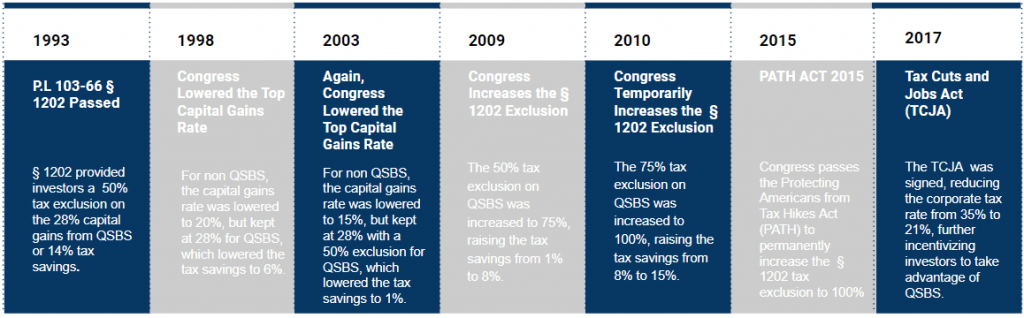

Section 1244 allows ordinary loss treatment with respect to the stock of small business corporations. To the extent that bias against C corporation status remains following the reduction in the corporate income tax rate and capital gain/dividend rate, section 1202 may reverse that bias in favor of C corporations by eliminating a second level of tax for some taxpayers, while subjecting the first level of tax to an historically low 21 percent tax rate. In addition, to the extent such gain is excluded from gross income, it is now also exempt from both the individual AMT and the net investment income tax. Generally, the gain exclusion is 50, 75, and 100 percent for QSBS acquired after August 10, 1993, February 17, 2009, and September 27, 2010, respectively. QSBS includes certain stock issued after August 10, 1993, in a domestic C corporation conducting a qualified active business. small businesses, many of which have difficulty attracting equity financing.” H.R. This provision was designed to provide “relief for investors who risk their funds in. Section 1202 allows certain noncorporate taxpayers to exclude 50 to 100 percent of gain from the sale of “qualified small business stock” (QSBS) held for at least five years. But buyer beware – there are hurdles, limitations, and traps galore to navigate for our clients. Section 1202 can eliminate the double tax burden on C corporations entirely with proper tax planning. To find the latest information on this topic, read Qualified Small Business Stock Can Provide a Strategic Advantage to Private Equity Groups and Venture Capitalists. The BDO Center for Healthcare Excellence & Innovation is devoted to helping healthcare organizations thrive, clinically, financially, and digitally. The BDO Center for Healthcare Excellence & Innovation BDO is continuously finding new ways to help your organization thrive. When it comes to business, innovation is changing everything. Stay abreast of legislative change, learn about emerging issues, and turn insight into action.

The insights and advice you need, everywhere you do business.

Innovative solutions to nonprofit organizations, helping clients position their organizations to navigate the industry in an intensely competitive environment.

Learn how we are encouraging diverse voices, empowering our people and taking action to effect change.īDO is here to help your business – and you – persevere through crises, prepare for recovery, and once again thrive.Įquipping boards with valuable resources to address growing responsibilities. Your one stop for accounting guidance, financial reporting insights, and regulatory hot topics. BDO Center for Accounting and SEC Matters

0 kommentar(er)

0 kommentar(er)